Airbnb is a great example of how venture capital investment can help drive an innovative project. This startup was created in 2007, as a simple business model, in which people can offer any space in their house as lodging, including breakfast, and at a much lower cost compared to hotels.

Although the value proposition of the company transformed the hotel industry, its exponential growth came once the injection of capital was obtained. As well as the network of contacts, mentoring, and expert advice from Y Combinator, a business accelerator that invests in early stages such as Airbnb.

The boost of ventures and early-stage companies is essential to the economic development of the countries. In Mexico, venture capital has become an option to encourage business growth, innovation, competitiveness, and employment creation. But, what is Venture Capital?

Index

What is Venture Capital?

Venture Capital is the investment in a company during its first years. Often, they only have one or three years of operation in the market, according to the definition of the Mexican Private Equity Association ((AMEXCAP by its acronym in Spanish).

Venture capital funds focus their efforts on promoting new companies and startups from very early stages. Their commitment to the companies in which they invest goes beyond the provision of capital, as they also provide mentoring, advice, and networks. In this way, they ensure success in their respective market.

This investment alternative is a response to the lack of access and options that small and medium-sized companies have in the first years of the life of their projects.

Venture capital, why AMEXCAP rename it in Mexico?

From the impulse that this type of investment, known in the United States as venture capital, AMEXCAP suggested naming it in Mexico as capital emprendedor, to offer a more familiar concept to the national investors.

The industry of Venture Capital or private equity, is an investment model that focuses on companies with high growth potential. In which are experienced investors that seek success in projects, while generating returns.

Firms of Venture Capital invest in different sectors of the economy and companies regardless of the stage they are in, according to AMEXCAP.

The sectors in which private equity industry invests are:

- Technology

- Health

- Transportation

- Consumption

- Infrastructure

- Financial services

You can also read: What are Private Equity funds and how does it work?

Characteristics of venture capital

Venture Capital funds attract the investor's money and, through specialists, are responsible for distributing it in companies with scalability opportunities. Also, they ensure the success in terms of profitability of companies through advice and mentoring for entrepreneurs and their teams.

This investment model focuses its efforts on private companies that are not yet listed on the stock exchange. They invest in them at any stage of their development, as long as they have an innovative model and great growth prospects.

What is a Venture Capital fund?

A Venture Capital fund invests in companies while they are in their earliest stages. These ventures or startups usually have specific qualities, such as:

- Early stages of development

- Scalable business model

- Disruptive and innovative

- High-impact ventures

Funds with this investment model are also considered temporary partners, according to the definition of the Ministry of Economy,since their main intention is to obtain a return on their investment. Therefore, they work together with the entrepreneur to ensure that profitability and established objectives are achieved.

Conoce más sobre What is a Venture Capital fund?

How Venture Capital funds stimulate the ecosystem?

A venture capital fund works thanks to the resources of investors. These are used to support the business model of disruptive companies. This allows, entrepreneurs to focus on creative and innovative processes.

Another important aspect is that a venture capital fund will take part in the decisions and management of the company. With this, the specialists that make it up, will seek to establish strategies that allow the exponential growth of the venture, which reduces risk and allows a better long-term return on investment for its investors.

You can also read: Key pieces in a Venture Capital fund in Mexico

Structure of a Venture Capital fund

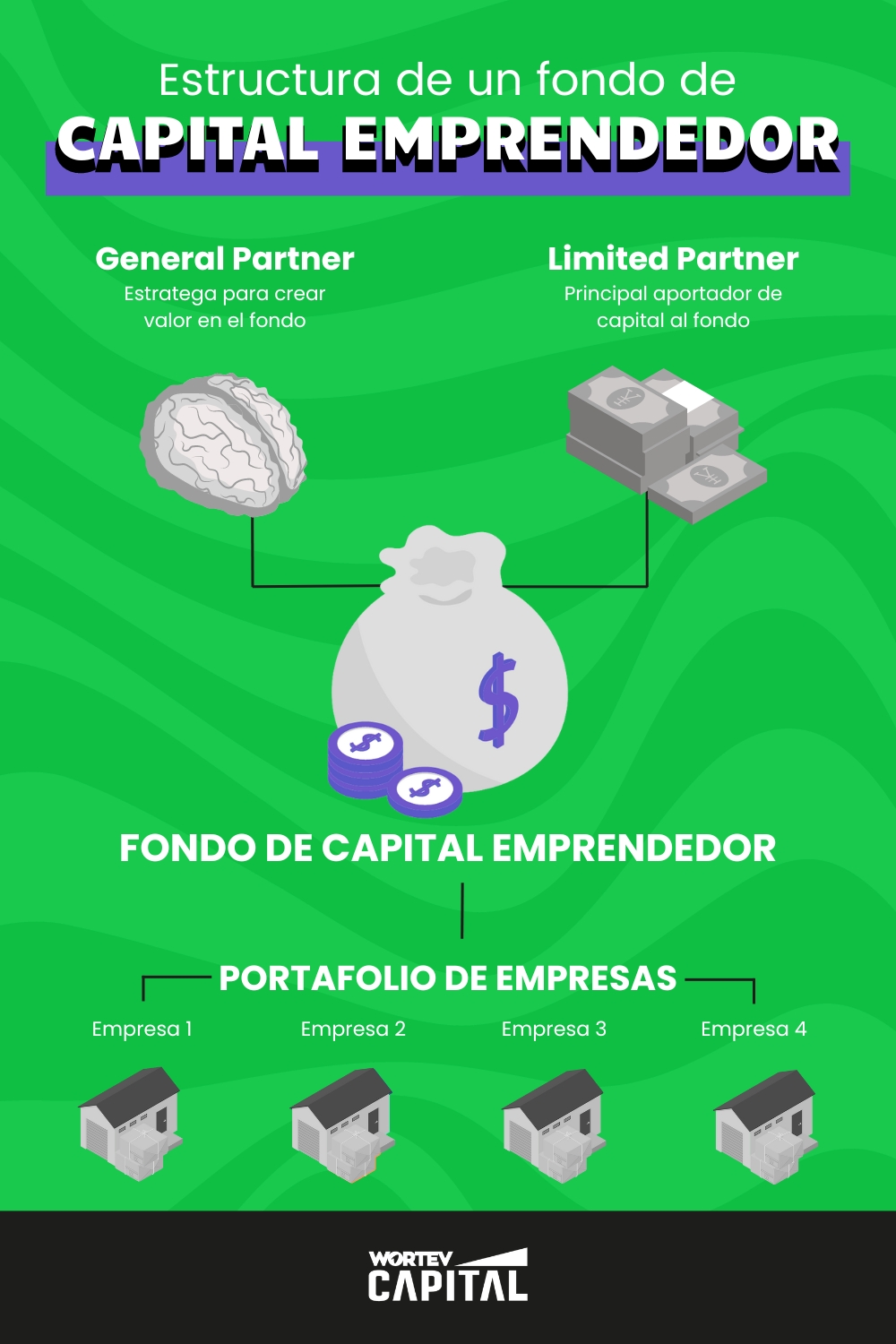

Venture Capital funds are made up of different key figures; investments portfolio, Limited Partner (LP) and General Partners (GP) (GP). This structure allows this investment model as a perfect gear:

- The investment portfolio is made up of the companies or startups that receive the capital that the fund has.

- The limited partnerare investors who are responsible for providing the capital.

- The general partnerare responsible for managing that capital and evaluate the best options within the fund’s portfolio to invest.

You can also read: General Partner vs Limited Partner, who is who?

How do private equity funds raise resources?

The resources obtained by private equity funds to invest in companies come from different sources:

- Limited partner

- General Partners (GP)

- Individual investors

Some private equity funds also include family office and retirement funds. On the other hand, the returns generated by ventures that are part of the investment portfolio of a private equity fund when achieving the established objectives are reinvested in other early-stage companies.

Why invest in ventures and startups?

Besides the returns it offers to its investors, as well as being an alternative with strategies to mitigate risk in investment, venture capital is an opportunity for the economic and social development of countries since:

- Provides liquidity to companies in their earliest stages

- Allow the growth of new businesses

- Boost entrepreneurship

- Encourages innovation and research

- Promote job creation

Venture Capital relevance in Mexico and LATAM

Venture Capital in Latin America and Mexico obtains relevance thanks to the fact that it is one of the main sources of capital for the development of entrepreneurship in the region. In this way, it stimulates economic growth in developing countries, generating a virtuous circle in which investment boosts businesses and employment creation.

Venture Capital funds are a great opportunity for project development. They provide capital at the earliest stages of companies when it is not yet possible to be sure of their success, so startups can obtain funds that otherwise could not.

On the other hand, the conditions offered by Mexico and Latin America to international Venture Capital funds are attractive since it is a very broad market, constantly growing, and with different needs to cover.

However, it is expected that during 2024 caution within the industry will remain globally. While in the region, venture capital funds choose truly disruptive business models that adapt to the needs and demands of investors and the market in general, according to information from Deloitte 's.

Conoce el Panorama de capital privado en Latinoamérica

WORTEV CAPITAL’s investment model is a pioneer in the private equity industry in Mexico. We invest in emerging companies through our venture capital fund.

The strategy focuses on including a business accelerator that supports the operation of companies in key areas for their growth. In this way, ventures have the necessary tools to improve processes and optimize areas, to achieve the established objectives in a shorter period.