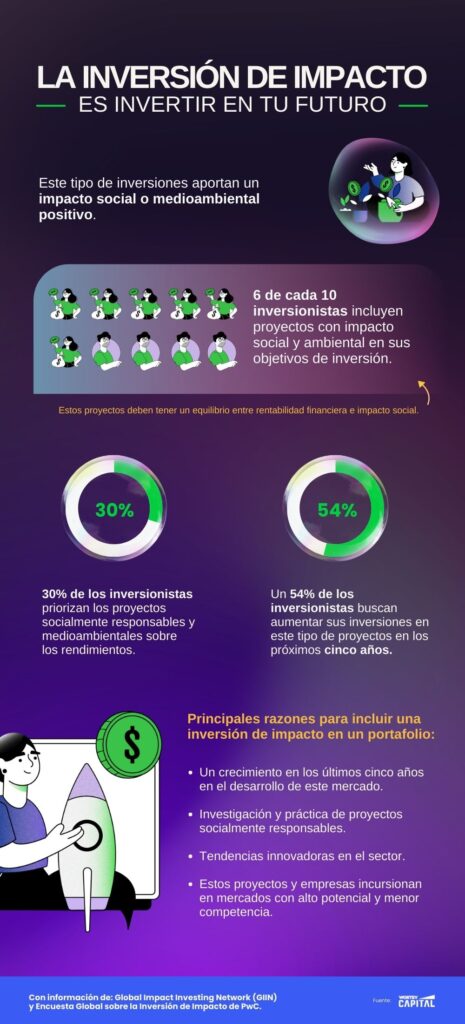

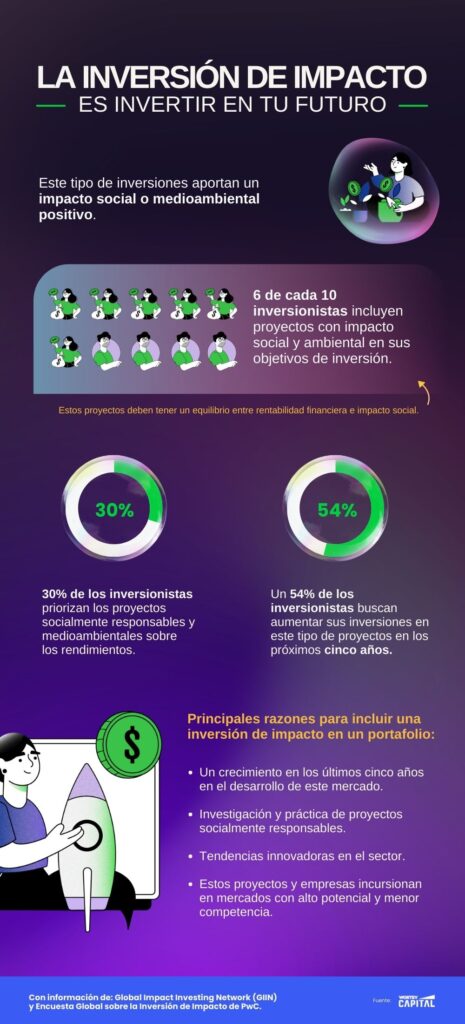

Impact investing impact investing promotes companies and projects with social and environmental causes. It is an alternative that optimizes the investor's return of the investorfrom companies omitted to care for the environment and with social responsibility. But, why is it important to invest in impact investment?

This type of investments focuses on instruments and companies that are sustainable or have the three environmental, social, and governance (ESG) factors. A trend that investors are increasingly adopting.

Impact investing impact investing impulsa empresas y proyectos con un enfoque social y medioambiental.

Esta alternativa llegó a transformar la inversión tradicional, y no solo beneficia al entorno, también optimiza el rendimiento financiero del inversionista, ya que estas empresas suelen ser más rentables que sus pares. Pero, ¿por qué es fundamental tener inversiones de impacto?

Este tipo de inversiones se concentra en instrumentos, o empresas que sean sustentables, o bien cumplan con los criterios Ambientales, Sociales y de Gobierno corporativo (ASG o ESG, por sus siglas en inglés). Esta tendencia se ha vuelto relevante entre los inversionistas individuales e institucionales por el rendimiento financiero e impacto positivo que ofrecen.

“Las inversiones están cambiando abismalmente, pues se busca invertir en proyectos que logren un ganar-ganar. Es decir, aquellas empresas que ofrezcan rentabilidad financiera, y también un impacto positivo en lo ambiental y social”.

–Denis Yris, CEO of WORTEV CAPITAL

El mercado mundial de inversión de impacto alcanzó los $1.16 billones de dólares, de acuerdo con el Global Impact Investing Network's GIINsight: Sizing the Impact Investing Market 2022 de Global Impact Investing Network.

Sin embargo, los 121 países en desarrollo y economías emergentes deberían invertir de 5 mil a 7 mil millones de dólares al año para cumplir con los Objetivos de Desarrollo Sostenible (ODS) de la Organización de las Naciones Unidas (ONU), de acuerdo con el International Monetary Fund (IMF).

The trend among investors to include these types of projects is attracting new participants. In the last two years alone, impact investing has expanded to other emerging markets such as Latin America and Asia.

You can also read: What is ESG? Everything you need to know to invest with impact

What is impact investing?

The GIIN define las inversiones de impacto como aquellas que tienen el objetivo principal de crear un impacto social y ambiental positivo y medible, al mismo tiempo que se genera una rentabilidad financiera. La organización, también, especifica que este tipo de inversiones cuentan con cuatro características principales:

- Intentionality: That is, there is a conscious desire to contribute to a measurable social or environmental benefit. Impact investors seek to solve problems and capitalize on opportunities.

- Use evidence and impact data in investment design: This type of investment needs to use evidence and data to drive smart investment design.

- Manage impact performance: This refers to having feedback loops and communicating performance information to help others in the investment chain manage the impact.

- Contribute to industry growth: Impact investors share their learning. In this way, they enable others to learn from their experiences, contributing to real development for social and environmental benefit.

Main reasons to promote impact investing

La creciente demanda por soluciones sostenibles ha impactado en la mentalidad de los inversionistas y el mundo de las inversiones, llegando a un contexto en el que el capital se percibe como un agente de cambio ante la crisis ambiental que enfrentamos a nivel global.

CEO of Disruptivo TV, in our WEBINAR investments that impact the world: social entrepreneurship, precisa que el mayor involucramiento de pequeñas empresas en dar solución a problemas del cuidado del medio ambiente y con impacto positivo en comunidades explican el crecimiento de este sector como alternativa de la inversión tradicional.

You can also read: Building an investment portfolio, a smart decision

Digital reinvention as a lever for development

La incursión de las tecnologías de la información (TI) en el mundo de las inversiones está en vías de transformar sectores clave para el desarrollo de cualquier economía. El desarrollo social se perfila como el responsable de eliminar las barreras que se interponen entre las personas y sus oportunidades.

The World Bank The World Bank recognizes this innovation as a digital gap generator that increases the inequalities among societies. Thus, digital development is one of the main challenges.

The aim is to equip the capital to participate fully in a digital economy. Hence the importance of promoting investing alternatives with a social approach.

In this regard, Juan del Cerro points out that technology evolved as a tool to promote projects and ventures with a social and environmental impact

“It's a way to make those projects more agile and far-reaching”.

You can also read: Private capital in Mexico: 5 reasons to invest in entrepreneurs

Investing for the future

The first report of the Alianza por la Inversión de Impacto en México (AIIMx) precisa que este tipo de inversiones anteponen la innovación y el emprendimiento para generar un cambio a escala, a la vez que ofrecen rentabilidad financiera.

In its analysis, impact investing seeks a social or environmental benefit. So by having a performance measurement of those investments and the profitability of their investments. The latter can change since it depends on the project and market where it was invested. The report also lists some options for promoting such investments:

- Use venture capital funds that consider projects in this niche.

- Develop payment systems schemes that promote investments with a social and environmental focus.

- Encourage the creation of funds for social purposes and care for the environment.

- Develop investment instruments in local economies to promote impact projects in the same region.

- Establish legal ways for entrepreneurs and investors to prioritize impact investments.

- Inclusion of impact investing in the national, regional and international development agenda.

"The idea is to support entrepreneurs who aim to impact the development of their employees, the community, the environment and investors."

-Denis Yris

At WORTEV CAPITAL we focus on investing in innovative Mexican companies and startups in traditional sectors with high growth potential. In addition, we promote projects that seek to generate social and environmental impact.