Technological trends and digital businesses have benefited the investment in venture capital in the Latin America region as a pull to development and impulse for emerging companies. In this dynamis in the region, 4 countries stand out as key players.

The Latin America region attacks venture capital investors' attention in emerging companies with a high impact and innovation.

Until the third quarter of 2022, transactions in venture capital in Latin America were concentrated in Brazil, Mexico, Colombia and Chile. Mexico and Colombia were the ones that grew the most in transactions, according to Transactional Track Record (TTRConsequence of dynamism is to stimulate the growth of new companies in early stages.

In this regard, José Enrique Alba, head of Corporate Innovation and Entrepreneurship at Tec de Monterrey, Business School, explains that these countries in the region have the potential to compete as a block due the talent in the entrepreneurial ecosystem as well as the opportunity of innovation.

Latin America's key players in venture capital

In recent years, the entrepreneurial ecosystem has developed exponentially. Situation that outlines the region as a new market with potential for private equity investors.

Within this region, countries such as Brazil, Mexico, Chile and Colombia stand out as the main countries with the highest flow of investment in private capital.

The venture capital market in Latin America registered a year with continued growth. The investors caution globally is maintained, however, the operations show dynamism and a favorable performance.

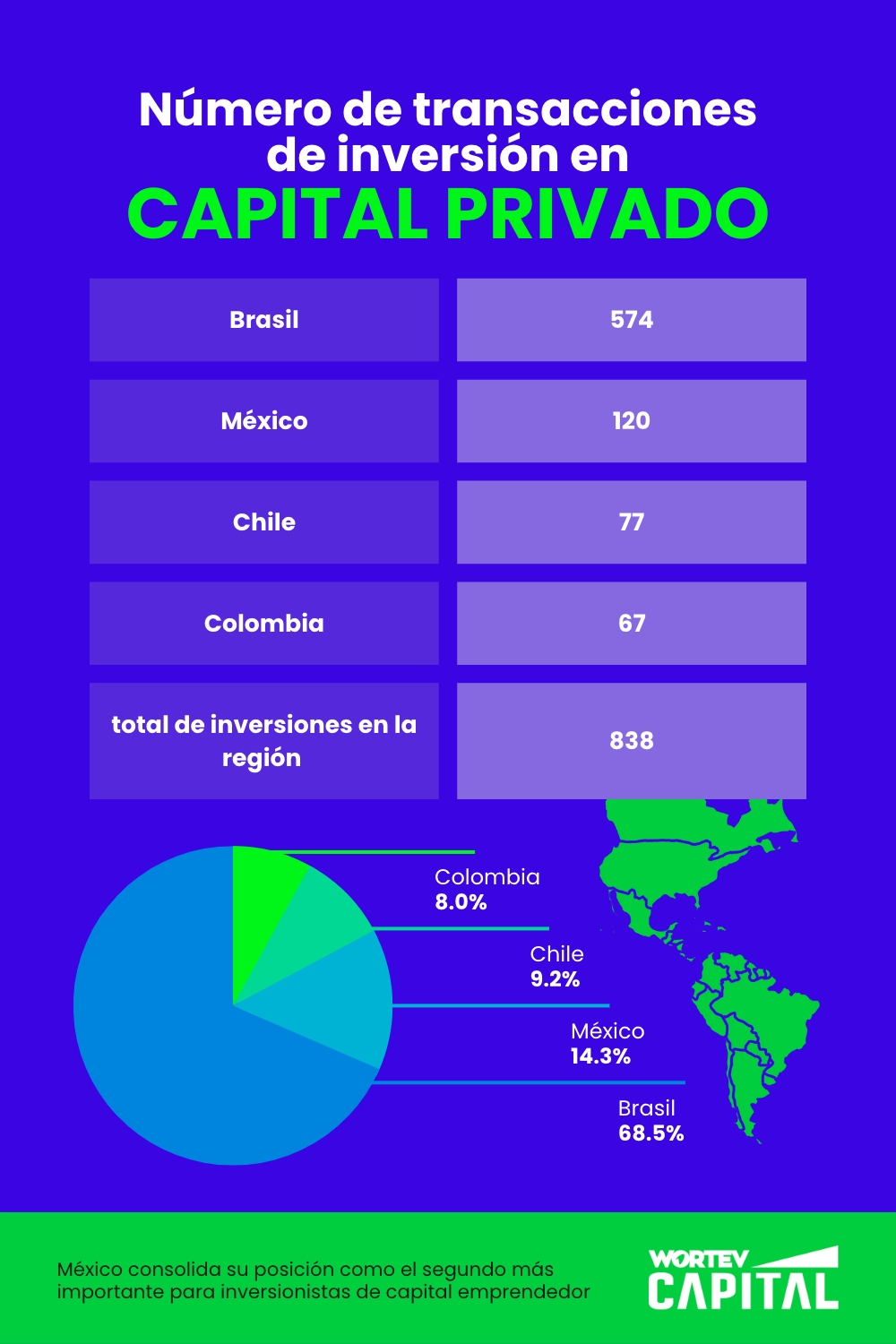

Brazil is the country that leads investment in the region. According to TTR data, this country registered 574 rounds of investment in venture capitalso far in 2022.

Mexico is the second country with the highest investment in the region. Until the third quarter of the year, the number of 120 venture capital transactions with a value of US $2,171 million dollars have been registered.

Chile and Colombia are in third and fourth position, respectively. Chile registered a total investment of 77 in venture capital so far this year. While Colombia registered 67 investments.

Venture capital giants in Latin America

This is the total of transactions registered by the 4 giants that drive the venture capital industry so far in 2021:

These figures indicated a recovery after the economic reactivation, also a result of a highest investment in emerging companies with an innovative vision.

José Enrique Alba, head of Corporate Innovation and Entrepreneurship at the Tec de Monterrey Business School.

“Today, venture capital investors seek countries like Mexico, but specially, beat their capital in the region. It makes sense that investors are looking at Latin America”.

Looking to consolidate itself as a block

In the region, innovation trends and digital business solutions bring the investors attention to Latin America. With it, venture capital investment.

José Enrique Alba explains that the conditions in the region makes it more attractive despite the undeveloped venture capital market.

The specialists clear up that more and more startups emerge with a digital model, which raises the requirement of capital for its growth. The objective of these emerging companies would be positioning in markets such as Colombia, Mexico and Brazil to consolidate as a region.

“In Latin America emerging startups such as KAVAK or Nubank that attract investors to the region” , he says.

The emerging companies strategy would be beaten for consolidation in the region and maintain an attractiveness for international investors.

Investment in innovation

Undoubtedly, investing in innovation is a fundamental part of maintaining the development of the venture capital industry. For the Latin America region, there are conditions to promote economic development and promotion of new companies.

According to CB Insights data, startups of Latin America origin are disruptive in industries like fintech and financial systems as the case of Nubank, a Brazilian company founded in 2013.

There are still missing mechanisms to promote investment in innovation and improve emerging companies with the capacity to attract more international investors. These four pillars can detonate the growth of investments in venture capital exponentially in the coming years.

As an investor, you can include in your strategy an investment in a venture capital fund.

If you want to know more about venture capital, come to WORTEV CAPITALa venture capital fund dedicated to promoting growth. Its main objective is to generate an ecosystem for investors and entrepreneurs that positively impacts everyone.